Since 2012, the city of Columbus has torn down more than 1,000 vacant houses to improve neighborhoods.

But the city is having trouble developing the lots.

One goal was to rebuild single family homes, but that’s only happened a few dozen times. One reason is the process is tough for average home buyers to navigate.

“Really Complicated”

Four years ago, the city tore down a blighted house at 142 Dakota Avenue. These days, the Franklinton lot has new life thanks to a charming, brand new two-story home with a covered front porch. Friendly flowers and manicured shrubs fill a front garden. Inside, it displays bold artwork and dynamic furniture.

Zach Reau loves his decor, particularly the yellow chair in the living room. He decided to purchase the house about three years ago after facing rising rents for apartments.

“I felt like owning a home would mean I wasn’t just throwing my money away, that I was building equity,” Reau says.

As a first-time, low-income buyer, Reau worked with the Franklinton Development Association, the non-profit that built the home.

But he ran into a lot of problems.

He couldn’t find an appraiser because no comparable houses were in the area. Then, as he was about to close the deal, the Franklinton Development Association said they couldn’t accept his FHA loan.

“It felt like a very mishandled, mismanaged system that we were in, but I’ve heard from a lot of other home buyers that it is really complicated.”

The city lowered the cost of the house when a private lender eventually approved Reau for less money. Tax abatements were supposed to help offset higher monthly payments, but two years into his stay, he says he still hasn’t received them.

Reau says his wide support system of family and friends was essential to his outcome, which, in the end, took about a year.

“I don’t think that a normal family or someone who is new to the area or someone without a wide variety of resources at their disposal would’ve been able to complete it.”

Land Bank Faces Tall Task

Stories like Reau’s illustrate the difficulty of redeveloping blighted neighborhoods.

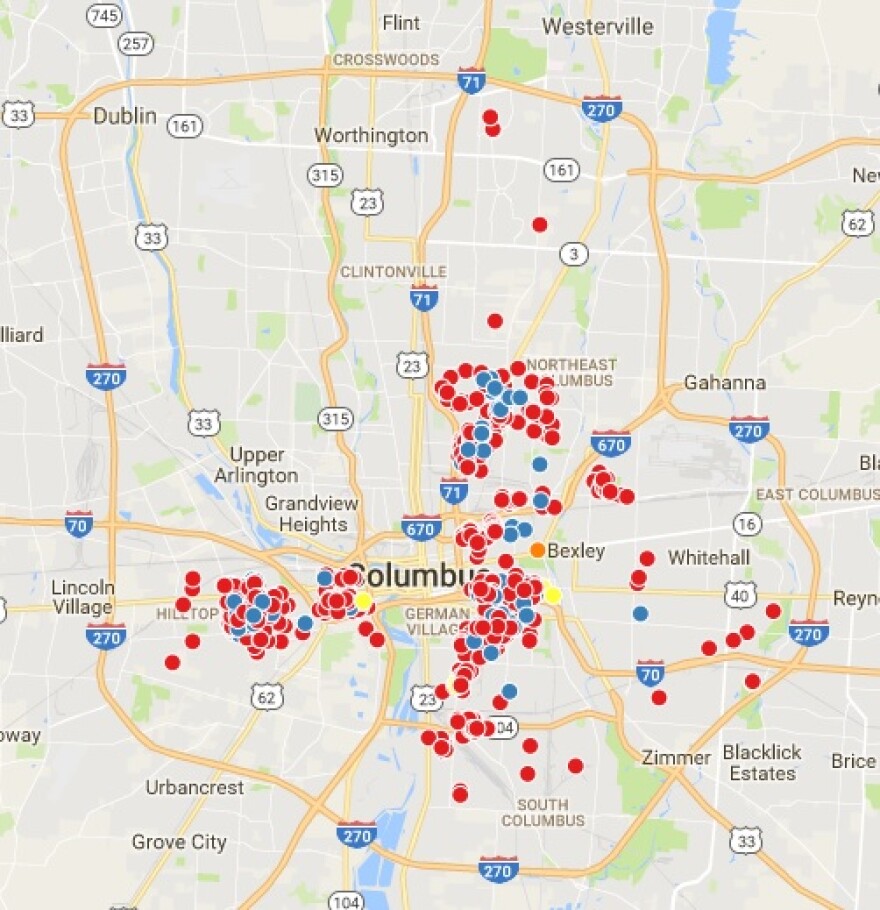

The Columbus Land Bank has demolished more than 1,000 properties since 2012, but land bank figures show only about four percent have been sold as single family homes.

Judy Box is the president of the Franklinton Area Commission. She wants to work with Columbus City Council to create a clear process for acquiring land bank properties.

She says making people include a housing plan with their application is unreasonable, as are the constantly-changing application requirements.

“The Franklinton Development Association, the city saved a lot of lots for them that no one else could buy. And the FDA then got the grants and it was quick slam dunk we can go ahead and do it,” Box says.

“When it’s John and Susie Smith that want to do it, it’s a different ball game.”

Columbus Land Bank Administrator John Turner says the land bank requires blueprints to help drive away speculators. Application requirements change to fix issues as they arise, but he says they try to honor existing applications.

He says the main challenge facing everyday people looking to buy an empty lot owned by the land bank, is the market.

“The hurdle has always been the cost to build a new house in the areas in which we own lots typically exceeds the post construction appraisal value of that house.”

Because of this, the land bank sells lots mostly to either adjacent property owners or nonprofit organizations, which build affordable or rental units.

Improving Neighborhoods

Ohio State professor Rachel GarshickKleit studies urban planning. She says promoting a wide variety of housing in all neighborhoods helps decrease economic inequality.

Kleit says two ways to help are weaving affordable housing into wealthier neighborhoods and promoting homeownership in low-income areas.

“If you’re focusing on ‘bringing a neighborhood back,’ then homeownership, very visible new fixing up of homes, is the way to get that market started again.”

Despite his difficulties, Reau says he finds it hard to complain.

“I got through the process and I got a great home that is worth way more than what I paid for it.”

Reau says he’s met great people and he loves Franklinton. Now, he hopes other people can have the same opportunity, too.